I have lots of tricks up my sleeve for saving bits of money here and there on benefit plans. Here is a list of some of the creative things I can do for your company to help either reduce, or control your benefit plan costs.

One of the more creative ways of controlling benefit costs is to make your employees more savvy consumers. If they were going out on their own to purchase prescription drugs or professional services with their own money you can be sure they would try and find the best price and value they could for their hard earned dollars. But because most plans are as easy as “Swipe, and go” employees often don’t think of way to save money. It all seems free to them.

First prescription fills are often the most wasted. When an employee is prescribed a new drug there are many unknowns, will it fix the problem? Will it have side effects? Will the problem go away before the prescription is used up? Most plans have a 3 months supply limit, where the maximum amount of drugs that can be dispensed at any one time is equal to 3 months. We can set up your plan to limit the maximum supply of the first and only the first time a new drug is dispensed. This is a slight inconvenience if the member needs to go for a refill, but each subsequent refill will be for 3 months. The benefits here are that if the drug in question is has some side effects or is ineffective, only a month is wasted, rather than 3 months.

Dispensing Fees can eat up a lot of plan dollars, for small prescriptions or for prescription of some low cost drugs like antibiotics the $12 dispensing fee you might pay is more than the cost of the medication. Going hand in hand with high dispensing fees are high drug prices. Costco or Wal-Mart have low dispensing fees and often similarly low drug costs, where small or private pharmacies might charge two or three times as much to dispense the same drug, they often also charge a premium for the ingredient as well. Making the employee pay the dispensing fee firstly reduces the costs directly paid by the plan, as well as it makes members shop around for a cheaper dispensing fee (and as a result cheaper drug costs). I have a list of dispensing fees by pharmacy located at this page on my blog.

Say no to 100% reimbursement. Plans will often have 80% coverage for Drugs or dental, but will occasionally leave the professional services (massage, chiropractor, naturopath etc.) at 100% coverage. Because employees see these services as “free” they will tend to take advantage and max out their benefits regardless of if they need the treatment for medical reasons or not. Massage therapy is especially notorious for this. When the member has some skin in the game, a 20% co-pay or even a $5 user fee, they think twice before spending recklessly.

Physicians recommendations can also be added to paramedical plans, so before a claims will be reimbursed the member must provide written medical evidence, usually in the form of a prescription from their doctor. The recommendations ensure that the treatment received is medically necessary. These referrals are easy for members actually suffering a problem to

Ensuring proper Co-ordination of benefits can help improve the coverage employees receive as well as improve the bottom line of your plan. if employees have duplicate coverage under their spouses plan, ensure that they are properly setup to take advantage of Co-Ordination of Benefits. If there is duplicate coverage, some of the bills invoiced on your plan perhaps could have been paid under the spouses plan, reducing the total impact on your claims history.

Deferred Drug Cards (DDC) are a new type of drug cards which have been popular in Quebec for some time but are now just branching out to the rest of the country. Great West Life is a big supporter of Deferred Drug Cards out west. DDC work similar to a Pay Direct Drug Card (PDDC) they allow electronic claims tracking, formulary control, and other benefits brought about by a normal drug card, however, the way the member get reimbursed is different. With a Direct Drug Card the member only pays their portion of the claim as defined by their co-pay. In a plan with an 80% co-pay and a $100 claim, the member only remits $20 to the pharmacy as their share. However, with a Deferred Drug Card the member pays the whole claim cost of $100 out of pocket. The claim starts a timer, the employee will be electronically reimbursed directly to their bank account as soon as one of two conditions is met.

1) A predefined time period elapses, say 30 days from the claim.

2) A predefined out of pocket maximum is reached, say $150.

The employee is out of pocket $100 from their drug claim. Because the member had to pay upfront they take on a more consumer savvy attitude, they think before they buy. The member might decide to go to a cheaper pharmacy, purchase a less expensive drug, take a smaller supply or simply decide they don’t need the prescription filled after all. These choices all reduce the cost of the plan. Once the time period is reached, again lets assume 30 days, an electronic fund transfer takes place and deposits $80 to the members bank account. Similarly, if they incurred another claim inside that 30 day period, which exceeded the out of pocket maximum of $150, the covered portion is deposited to the members account.

All of these ideas revolve around making your employees better consumers. Take advantage of cheaper vendors, utilize other available coverage, think before you spend. None of these changes create huge savings up front, they do however help control claims and rates over time. The cost of benefit plans is rapidly increasing all the time, these are all perfect ways to slow that increase down.

--

Robert Reynolds, GBA

Certified Group Benefits Advisor

Hendry McKenzie Reynolds Employee Benefits Ltd.

Toll Free: 1-888-592-4614

rob@hmrinsurance.ca

www.hmrinsurance.ca

E.O. E.

Thursday, December 16, 2010

Thursday, November 18, 2010

New ACS Buck Health Care Trends Survey for 2010

I am a big fan of the ACS Buck Health Care Trends Survey that comes out each year. This year marks the 6th year of the survey. Basically they track the cost of claims paid by the major insurers in Canada to determine trend factors for drugs, hospital, professional services and dental care.

I use this report with all my renewals to show the rate at which health care costs are increasing each year. If you are a HR professional or in charge of a benefits plan I recommend giving it a read.

Source: http://www.acsbuckcanada.com/buckconsultantsca/Default.aspx?tabid=337

--

Robert Reynolds, GBA

Certified Group Benefits Advisor

Hendry McKenzie Reynolds Employee Benefits Ltd.

Toll Free: 1-888-592-4614

rob@hmrinsurance.ca

www.hmrinsurance.ca

E.O. E.

I use this report with all my renewals to show the rate at which health care costs are increasing each year. If you are a HR professional or in charge of a benefits plan I recommend giving it a read.

Source: http://www.acsbuckcanada.com/buckconsultantsca/Default.aspx?tabid=337

--

Robert Reynolds, GBA

Certified Group Benefits Advisor

Hendry McKenzie Reynolds Employee Benefits Ltd.

Toll Free: 1-888-592-4614

rob@hmrinsurance.ca

www.hmrinsurance.ca

E.O. E.

Tuesday, October 26, 2010

New Agency Managment System.

It has been a while since my last post, I have been very busy and there hasn't been too much news in the insurance world the last while.

One new item is that our agency has purchased a new group insurance software package which is making us more efficient at tracking customer interactions, requesting quotes as well as providing proposals to our clients.

Some of the nice features from my side of the desk are that I can better build and track requests for quotes. Usually when I make a RFQ one or two companies come back with either incorrect volumes or deviations in the plan designs. This makes it difficult to compare plans, as they aren't apples to apples. I can now track these volume and plan deviations much more simply and clearly so my recommendations are more accurate than ever and clients know exactly what they are going to get.

One of the best features from the clients side of the table, is that when they complete the initial employee census I need to produce a quote, I can turn this around and pre-populate application forms for their employees, which GREATLY simplifies and streamlines the enrollment process. An example is given below.

Neat eh?

--

Robert Reynolds, GBA

Certified Group Benefits Advisor

Hendry McKenzie Reynolds Employee Benefits Ltd.

Toll Free: 1-888-592-4614

rob@hmrinsurance.ca

www.hmrinsurance.ca

E.O. E.

One new item is that our agency has purchased a new group insurance software package which is making us more efficient at tracking customer interactions, requesting quotes as well as providing proposals to our clients.

Some of the nice features from my side of the desk are that I can better build and track requests for quotes. Usually when I make a RFQ one or two companies come back with either incorrect volumes or deviations in the plan designs. This makes it difficult to compare plans, as they aren't apples to apples. I can now track these volume and plan deviations much more simply and clearly so my recommendations are more accurate than ever and clients know exactly what they are going to get.

Neat eh?

--

Robert Reynolds, GBA

Certified Group Benefits Advisor

Hendry McKenzie Reynolds Employee Benefits Ltd.

Toll Free: 1-888-592-4614

rob@hmrinsurance.ca

www.hmrinsurance.ca

E.O. E.

Tuesday, August 10, 2010

Youtube

I am on the Youtubes

Believe it or not this was the best take out of about 10...

Olympia Trust http://www.olympiatrust.com/

Great for sole proprietors as it allows you to send in funding with claims, you dont have to prefund the trust.

Benecaid https://www.benecaid.com/

Great for employee groups as there is no setup fee, the trust can be funded monthly, quarterly or annually.

Blog Post on Health and Welfare Trusts http://canadianlifeandhealthinsurance.blogspot.com/2009/10/private-health-services-plans-aka.html

--

Robert Reynolds, GBA

Certified Group Benefits Advisor

Hendry McKenzie Reynolds Employee Benefits Ltd.

Toll Free: 1-888-592-4614

rob@hmrinsurance.ca

www.hmrinsurance.ca

E.O. E.

Believe it or not this was the best take out of about 10...

Olympia Trust http://www.olympiatrust.com/

Great for sole proprietors as it allows you to send in funding with claims, you dont have to prefund the trust.

Benecaid https://www.benecaid.com/

Great for employee groups as there is no setup fee, the trust can be funded monthly, quarterly or annually.

Blog Post on Health and Welfare Trusts http://canadianlifeandhealthinsurance.blogspot.com/2009/10/private-health-services-plans-aka.html

--

Robert Reynolds, GBA

Certified Group Benefits Advisor

Hendry McKenzie Reynolds Employee Benefits Ltd.

Toll Free: 1-888-592-4614

rob@hmrinsurance.ca

www.hmrinsurance.ca

E.O. E.

Tuesday, August 3, 2010

New Generic Drug Reform Coming to BC

A new agreement was signed between the B.C. Ministry of Health Services, the BC Pharmacy Association (BCPhA) and the Canadian Association of Chain Drugstores (CACDS). The new Pharmacy Services Agreement, available at www.health.gov.bc.ca/pharmacare/suppliers/psa.pdf will come into effect on July 28, 2010.

--

Courtesy of Manulife Financial

Generic drug prices to be reduced in BC

The BC Ministry of Health Services and the BC Pharmacy Association (BCPhA) and Canadian Association of Chain Drug Stores (CACDS) have negotiated a new Pharmacy Services Agreement that comes into effect July 28, 2010. Although the agreement is not binding on individual pharmacies, it is expected that most, if not all, pharmacies will comply.

This is good news as plan sponsors will benefit from the cost-savings attributed to lower cost generics on the PharmaCare formulary. The expected savings between October 15, 2010 and July 3, 2011 is about 3.7% of drug costs. This savings will vary significantly by plan depending on the make up of the plan and demographics.

Generic drug pricing

The agreement applies to both public and private payers and the following price reductions will be phased in over the next two years:

Dispensing fees

The Ministry also announced increases to the PharmaCare dispensing fee. These increases, although applied to the public plan, will result in a shift in marketplace conditions and will erode some of the savings to private payers.

Manulife will adjust our reasonable and customary fees in accordance with these changes.

Re-investing in Pharmacy Services

The Province will gradually increase the funding available to support pharmacy in the provision of clinical services. By 2013, the Province is committed to investing $35 million annually for pharmacy clinical services.

Manulife will continue to work with the BC government and other industry stakeholders to help ensure that group benefits plans continue to be affordable.

For more information on the changes to PharmaCare in BC:

http://www.health.gov.bc.ca/pharmacare/newsletter/10-007news.pdf

--

TL;DR - Generic Drugs In BC Just got about 50% cheaper!

The jist of the new agreement is that generic prescription drugs will be price caped at 35% of the Brand Name drug starting in 2012.

If a Prescription Drug costs $100 the generic equivalent can cost no more than $35.

Implications for extended health plans in BC

- If you currently reimburse for Brand Name drugs, change the coverage to Generic and save yourself a bundle.

- If you currently have paper reimbursement of drugs, you automatically have Brand Name drug coverage, as the insurance companies cannot instruct the pharmacy to dispense the generic at the point of sale.

- If you have a paper reimbursement drug plan, you will need to switch to a drug card to allow for a generic drug formulator.

Courtesy of Manulife Financial

Generic drug prices to be reduced in BC

The BC Ministry of Health Services and the BC Pharmacy Association (BCPhA) and Canadian Association of Chain Drug Stores (CACDS) have negotiated a new Pharmacy Services Agreement that comes into effect July 28, 2010. Although the agreement is not binding on individual pharmacies, it is expected that most, if not all, pharmacies will comply.

This is good news as plan sponsors will benefit from the cost-savings attributed to lower cost generics on the PharmaCare formulary. The expected savings between October 15, 2010 and July 3, 2011 is about 3.7% of drug costs. This savings will vary significantly by plan depending on the make up of the plan and demographics.

Generic drug pricing

The agreement applies to both public and private payers and the following price reductions will be phased in over the next two years:

| Effective date | Description of change | Price compared to brand |

| July 28, 2010 | Generic drugs added to PharmaCare since January 1, 2009 | 42% of the manufacturer list price for the equivalent brand |

| October 15, 2010 | New generics Existing generics (on PharmaCare prior to January 1, 2009) | 42% of brand 50% of brand |

| July 4, 2011 | Existing and new generics | 40% of brand |

| April 2, 2012 | Existing and new generics | 35% of brand |

Dispensing fees

The Ministry also announced increases to the PharmaCare dispensing fee. These increases, although applied to the public plan, will result in a shift in marketplace conditions and will erode some of the savings to private payers.

| Effective date | Dispensing fees |

| July 28, 2010 | Moves from $8.60 to $9.10 |

| October 15, 2010 | $9.60 |

| July 4, 2011 | $10.00 |

| April 2, 2012 | $10.50 |

Manulife will adjust our reasonable and customary fees in accordance with these changes.

Re-investing in Pharmacy Services

The Province will gradually increase the funding available to support pharmacy in the provision of clinical services. By 2013, the Province is committed to investing $35 million annually for pharmacy clinical services.

Manulife will continue to work with the BC government and other industry stakeholders to help ensure that group benefits plans continue to be affordable.

For more information on the changes to PharmaCare in BC:

http://www.health.gov.bc.ca/pharmacare/newsletter/10-007news.pdf

--

TL;DR - Generic Drugs In BC Just got about 50% cheaper!

Wednesday, June 30, 2010

Group Benefits GST/HST Update

Courtesy of Sun Life Focus Update

#237

PDF version

PDF version

Background

The Department of Finance (Canada) released information on February 25, 2010, called “Place of Supply, Self-Assessment and Rebate Rules for Harmonized Sales Tax” followed by the regulations on April 30, 2010 providing the Place of Supply legislative framework.Now that the regulations are enacted, we can finalize our administration processes based on the general Place of Supply rules regulations.

Sun Life previously communicated with you about the GST/HST and the Place of Supply rules. Here is a link to the most current communication for your review.

General Place of Supply rules

The overall purpose of the Place of Supply Rules is to determine in which province the supply has been deemed to occur and, therefore, which sales tax rate will apply. The new general Place of Supply rules will rely on the location of the service recipient (i.e. the plan sponsor). Previously, the emphasis was on the location of the supplier (i.e. Sun Life) when determining the applicable sales tax rate.How will the GST/HST be applied?

For Group Benefit services where GST/HST will apply on our fees, the regulations released by the Department of Finance, as well as the June 2010 edition of the GST/HST Technical Information bulletin released by CRA (B-103 – Harmonized Sales Tax; Place of supply rules for determining whether a supply is made in a province) were used to determine that the GST/HST be applied based on the contract address of the Plan sponsor – not where the service is performed.For details about the services where GST/HST applies, please refer to the Frequently Asked Questions (FAQ) document attached.

Examples of how the rates will apply:

- If a plan sponsor’s contract address is New Brunswick, the 13% HST rate will be used for all invoices/statements mailed.

- If the plan sponsor’s contract address is Quebec, then the 5% GST and 7.5% QST rates will be used for all invoices/statements mailed.

- If the plan sponsor’s contract address is Alberta, then the 5% GST rate will be used for all invoices/statements mailed

Overview of GST, HST or QST rates by Province:

| Province | GST/HST/QST Rate |

| British Columbia | 12% |

| Ontario | 13% |

| Quebec | 7.5% |

| New Brunswick | 13% |

| Nova Scotia | 13% (effective July 1, 2010, rate increases to 15%) |

| Newfoundland and Labrador | 13% |

| Other provinces/Territories | 5% GST |

Other Relevant Details

Ontario Retail Sales Tax (ORST) – 8%For invoices/statements where HST will be collected, the Ontario Retail Sales Tax of 8% will not apply on the fees. However the 8% ORST will continue to be collected on:

- ASO claims cost based on provincial distribution plus ASO fees where HST is not collected

- Group insurance premiums

As previously communicated, the new Place of Supply rules became effective on services performed on or after May 1, 2010, in New Brunswick, Nova Scotia and Newfoundland and Labrador.

It is Sun Life’s understanding , based on documents from the Quebec Budget, that the Place of Supply Rules for the QST at 7.5% (8.5% effective January 1, 2011 and 9.5% effective January 1, 2012) will also be effective May 1 , 2010. We continue to monitor this and will update you after the regulations are published.

The new rules will only become effective in Ontario and British Columbia on services performed on or after the July 1, 2010 HST implementation date.

Other Taxes

The only change slated for the other taxes applicable on Group Benefit products and services is in Quebec where the compensatory tax rate has increased from .35% to .55% effective March 31, 2010. This change increased the premium tax rate to 2.55%.More Information

Here is a link to the Frequently Asked Questionsdocument which may be helpful. You should also contact your tax advisor to ensure you have the information you need to be ready for these tax rates changes.Monday, June 28, 2010

Survey your employees, find out what they really want in a benefits plan.

I have recently been doing surveys of my clients employees. I have been asking a series of questions aimed at determining the areas employees value the most. the ultimate goal is to give teh employer hard data they can use to customize their plan. Dollars can be directed to benefits most appreciated by the employees and away from areas with little value.

Which benefits do you value the most? (1 = highest importance, 5 = lowest importance)

- Life Insurance

- Disability Insurance

- Extended Health Care

- Dental Care

- Critical Illness Insurance

Would you be willing to contribute via payroll deductions to a health and dental plan?

- Yes

- No

Would you be willing to contribute via payroll deductions, to a health and dental plan if the plan you received was better than if you did not contribute.

- Yes

- No

If the cost of your benefits plan increased, and your employer was unable to pay the additional cost, would you...

- Reduce benefits to maintain the current cost

- Maintain benefits at current levels and increase your own contributions

Which Health Care benefits are most important to you? (1 = Highest importance, 4 = lowest importance)

- Prescription Drug Coverage

- Professional Services such as Chiropractor and Massage

- Hospital and Ambulance coverage

- Vision Care and Eye Exams

Electronic Drug Cards add approximately 15% to the cost of your benefits plan. Is the convenience of a drug card worth the additional cost?

- Yes

- No

Would you accept a more basic health and dental plan if you were given a flexible Health Care Spending Account?

- Yes

- No

Some of the questions are listed below. For a comprehensive survey of YOUR employee group contact me and I would be happy to provide the survey free of charge.

Wednesday, June 16, 2010

Care for stroke patients: $50,000 in first 6 months

The Canadian Press

Date: Tuesday Jun. 8, 2010 10:05 AM ET

The national study tallied the financial cost of a stroke in the first six months -- to both the health-care system and the patient -- and found the expense adds up to an average of $50,000 per person, with about 20 per cent of that hitting families in the pocketbook.

When the $50,000 total is multiplied by more than 50,000 new strokes per year in the Canadian population, it works out to a whopping $2.5 billion or more a year, according to the Burden of Ischemic Stroke study being presented Tuesday at the Canadian Stroke Congress in Quebec City.

"We wanted to know how much stroke costs the health-care system and patients and their families, and there had never been a national study done on this prior to this," said Dr. Mike Sharma, deputy director of the Canadian Stroke Network.

"We looked at 12 different hospitals spread across the country from Halifax to Vancouver, and we took patients who'd had stroke, after they were leaving the hospital, and gave them a diary and arranged to meet with them periodically afterwards."

Sharma, who's with the University of Ottawa and Ottawa Hospital, led the study with Dr. Nicole Mittmann of Sunnybrook Health Science Centre in Toronto. They looked at the health-care costs of 232 patients.

In their diaries, patients or a caregiver tracked appointments, medications, whether they'd had to buy canes or wheelchairs, or modify homes with ramps or other features to make them safe and accessible. They also factored in how much time a caregiver had to spend away from a job.

Sharma said the grand total came as a surprise to him.

"The average cost over the first six months was $50,000 -- and this is probably about double what I would have estimated prior to this data being available," he said.

The personal tallies ranged from a low of about $2,000 for those who essentially had no disability to more than $200,000 for individuals who were quite disabled, he said.

The average length of stay in hospital after a stroke varies widely. Sharma said Ontario has worked hard to reduce the time, and it's now less than 10 days on average in the province, but "considerably more" in other jurisdictions.

In terms of a breakdown, he was also surprised to find that 80 per cent of the total cost was related to the health-care system, in particular hospitalization, while the other 20 per cent related to lost time from jobs and expenses for families.

"The times where it makes life very difficult are in those individuals who aren't covered with health-care plans, and when the primary breadwinner in the family has been affected by stroke. So there you've got the worst of both worlds. The income for that family declines while their costs go up."

After someone has a stroke, Sharma said medications are needed to prevent more stroke and for depression and sleep issues that arise.

Frank Nieboer of Calgary can speak from experience about the difficulties families face when someone has a stroke. His wife Lou had an aneurysm -- bleeding in the brain -- 33 years ago at the age of 32.

After seven weeks in hospital, she was deemed stable enough to come home, but she was in a wheelchair and had lost the use of her right arm, right leg, her ability to speak, and she was "massively depressed" and crying all the time, he said.

"And here I am, I'm 33, I've got a day job, thank you very much, and what are we doing?" he said. "It's really a learning curve."

Lou's income was wiped out because she had to resign her bank job. Fortunately, Nieboer was in a good financial position and able to get private help for physiotherapy, occupational therapy and assistance working on speech and cognitive processes.

The Nieboers formed a support group in Calgary and have helped counsel many families, hearing in the process numerous stories about the crippling financial burden of stroke.

"A lot of younger families, it results in family breakup," Nieboer said. Sometimes a breadwinner leaves a partner and young children after the partner's had a stroke, and the family must turn to social supports, he said.

Other times, a breadwinner -- for instance a trucker, teacher or lawyer -- can't work because of physical effects, or the impact on the ability to speak. Cognitive processes can also be affected.

"You may present very well from the outside, but a lot of folks have what I call invisible deficits. They can't process information. They can't quickly process and respond," Nieboer said.

Sharma said 50,000 to 60,000 strokes a year are diagnosed, but 10 times that number are covert. It's known they occurred because scars are seen on imaging, but they weren't diagnosed because there were none of the classical symptoms. They are, however, associated with dementia and long-term difficulties.

About 87 per cent of diagnosed strokes are due to blocked blood vessels, while 13 per cent are due to bleeding, Sharma said. There are effective treatments for the blockages, such as the clot-busting medication tPA.

"If we can get at it very quickly in a centre that has expertise and if we give that treatment, we know that the probability of disability is decreased by a third," he said.

"And that is what you need to do to shift that burden from somebody who is significantly disabled to somebody who has absolutely no disability, and consequently shift the cost from those very large numbers down to one-hundredth of them."

Labels:

Critical Illness,

Critical Illness Insurance,

Stroke

Wednesday, June 9, 2010

Creative Employee Benefits solutions

Looking for creative employee benefits solutions? Look what some innovative companies are doing for their employees.

[1] http://www.inc.com/top-workplaces/2010/profile/new-york-jets-woody-johnson.html

[2] http://www.inc.com/ss/portionpac-great-place-work

[3] http://www.inc.com/top-workplaces/2010/index.html

[4] http://www.inc.com/top-workplaces/2010/a-look-inside-the-un-factory.html

[5] http://www.inc.com/top-workplaces/2010/how-to-build-a-beautiful-company.html

Published on Inc.com (http://www2.inc.com)

10 Perks We Love

Pressed for time

McGraw Wentworth, a provider of group benefits, offers on-site pickups and return of clothes that need laundering.

A free ride

Workers at Cooper Pest Solutions can use company vehicles for their commutes. Light trucks for service technicians; Toyota Scions for sales folks.

Lunch is served

Dealer.com, which helps auto dealers with their online marketing, serves locally grown organic treats in its on-site café. Employees can have their subsidized meals delivered deskside.

Swept off your feet

Akraya, an IT staffing company, sends professional cleaners to employees' homes every two weeks.

Bonus prizes

Van Meter Industrial, a distributor of automation and electrical products, awards points for activities such as participating in its Biggest Loser contest and walking campaigns. Employees redeem points for personal fitness items, such as running shoes, golf clubs, and jogging strollers.

Do your own thing

Azavea, a maker of mapping software, follows Googlesque practices of letting employees spend up to 10 percent of their time on research projects of their own devising.

Bon voyage!

LoadSpring Solutions, an enterprise software company, believes people grow by experiencing other cultures. Employees who travel abroad for vacation receive up to $5,000 and an extra week off to expand their horizons.

Bring the kids

Fentress Architects invites employees' relatives to participate in some of the evening and weekend classes offered through its in-house education program.

Dinner's on us

After five years at NewAge Industries, a manufacturer of plastic tubing, each employee receives a yearly $720 charge card to use in the restaurant of the William Penn Inn, a 296-year-old landmark near the company's headquarters in Southampton, Pennsylvania.

Helping you help out

Patagonia, the outdoor-apparel maker, gives employees two weeks of full-paid leave to work for the green nonprofit of their choice.

© 2010 Mansueto Ventures LLC. All Rights Reserved.

Inc.com, 7 World Trade Center, New York, NY 10007-2195

Inc.com, 7 World Trade Center, New York, NY 10007-2195

Source URL: http://www2.inc.com/ss/10-perks-we-love

Links:[1] http://www.inc.com/top-workplaces/2010/profile/new-york-jets-woody-johnson.html

[2] http://www.inc.com/ss/portionpac-great-place-work

[3] http://www.inc.com/top-workplaces/2010/index.html

[4] http://www.inc.com/top-workplaces/2010/a-look-inside-the-un-factory.html

[5] http://www.inc.com/top-workplaces/2010/how-to-build-a-beautiful-company.html

Thursday, May 27, 2010

Generic Drugs Vs. Brand Name Drugs

I found this great Infographic on the differences between Generic and Brand Name Drugs. Hat tip to Mint.com where I found it.

Labels:

brand name drugs,

generic drugs

Tuesday, May 25, 2010

The Future

I have a new carrier I have been working with for about 6 months or so now. Their name is Benecaid, and I think they have one of the best product offerings availible today. They have a nifty little 7 minute video which I uploaded to Youtube that explains it all really well.

This is the Future of benefit plans.

This is the Future of benefit plans.

Friday, May 21, 2010

A Benefit plan – The Basics

You are a business owner, an employee comes to you and asks if you would pay for their dental bill. You agree, congratulations you just started a benefits plan.

Now what if that same employee has an embarrassing medical condition, you said you would pay for their bills, but the employee doesn't want you to know about their private medical history. We now have a need for a third party who can process the claims confidentially. These third parties are usually insurance companies or trust companies.

There is a possibility that the employee could have very expensive medical claims down the road, possibly in the tens of thousands of dollars. As a business owner that is too much of a risk to take on by yourself, you still want to provide the benefits, but not be on the hook for a huge claim. An insurance company will gladly take that risk for you in exchange for health insurance premiums.

Another way to limit your liability is to simply say that you will pay for expenses up to a certain dollar amount, but no more. This is the basis of a Health Spending Account, every employee gets a predefined amount of money they can spend on healthcare and once it is gone, the business is no longer liable.

Through both insurance and a dollar maximum the business owner can control their liability. But what if employees start to abuse the benefits? What if they start claiming expensive cosmetic procedures like Botox, or gold teeth? Plan designs can be put in place to control what is eligible and what is not eligible.

Governments like healthy citizens, so benefits payments are given preferential tax status. Paying for medical or dental claims is a deductible business expense for the business owner, and the cost is not added to the income of the employee. This way the business gets a write-off and the employee doesn't pay income tax on the benefit they receive. Because of this taxation the benefits payments are far more affordable than paying a similar raise or bonus.

Labels:

dental plan,

employee benefits,

group insurance

Tuesday, May 11, 2010

Is you benefits plan in the crapper? We can help flush away your problems!

I take business seriously, but I find it all too easy to make fun of myself.

This is a stupid little video I made for a friend (Chris Vleck of Strategic Insanity) who was doing a "How NOT to make a promotional video" seminar. There were other videos with poor framing, bad sound, terrible lighting and loud background noise. This just happens to be my favorite.

I never miss an opportunity for self deprecating humor!

This is a stupid little video I made for a friend (Chris Vleck of Strategic Insanity) who was doing a "How NOT to make a promotional video" seminar. There were other videos with poor framing, bad sound, terrible lighting and loud background noise. This just happens to be my favorite.

I never miss an opportunity for self deprecating humor!

Labels:

employee benefits,

puns,

toilet humor

Monday, May 10, 2010

A tooth ache can be taxing.

Claims paid through a Dental Plan are Tax Free!

No Dental Plan

Salary $1438

Taxes (30.5%)* ($438)

Net for Dental Claim $1000

Vs.

Dental Plan

Dental Claim (non-taxable) $1000

Taxes (0%) $0.00

Net for Dental Claim $1000

Tax Cost Difference $438

*income of $62,000 average BC combined provincial and federal tax rate 25.22% ($12,485), Employment Insurance Employee and Employer Contribution 4.15% to $43,000 ($1784), Canadian Pension Plan Employee and Employer contribution 9.9% of $47,200, ($4672). Total taxes and deductions, ($12,485 + $1,784 + $4,672 = $18,941) effective average tax rate 30.5%

Friday, May 7, 2010

Why Price sometimes doesn't matter

When thinking about how Health and Dental insurance is priced it is easy to get confused.

Because these benefits are usually "Expereince Rated", that is to say high claims beget high premiums, and low claims beget low premiums, price is really determined by the claims, not the insurance company.

If I compared two identical groups, but one claimed $10,000 a year, and the other claims $20,000 per year, there would be a direct correlation in the premium they pay. Moving the high claiming group to a different carrier isnt going to reduce their premium to $10,000. Maybe you can save a bit on Admin expenses (refer to last weeks post comparing Manulife and Wawanesa) or maybe the carrier is willing to take a loss in the first year to earn the business, but in the long run your premiums are going to be based on your claims.

Sure there is some pooling going on, and one carriers pool might be better than the next, but over time this pooling drops away, and we are never given info regarding the pool. Is the group in the fancy French springwater pool with great claims? or in stinky sewage pool?

When it comes down to it, if you are happy with your carrier and they are doing a good job you should consider staying with them. That is of course assuming "good job" encompasses things like fair renewals and efficient TLRs.

At the end of the day, if you take away the marketing dollars, the new business discounts, and the other fluff that clouds the way, two identical groups with identical claims but different carriers should see the exact same rates.

Because these benefits are usually "Expereince Rated", that is to say high claims beget high premiums, and low claims beget low premiums, price is really determined by the claims, not the insurance company.

If I compared two identical groups, but one claimed $10,000 a year, and the other claims $20,000 per year, there would be a direct correlation in the premium they pay. Moving the high claiming group to a different carrier isnt going to reduce their premium to $10,000. Maybe you can save a bit on Admin expenses (refer to last weeks post comparing Manulife and Wawanesa) or maybe the carrier is willing to take a loss in the first year to earn the business, but in the long run your premiums are going to be based on your claims.

Sure there is some pooling going on, and one carriers pool might be better than the next, but over time this pooling drops away, and we are never given info regarding the pool. Is the group in the fancy French springwater pool with great claims? or in stinky sewage pool?

When it comes down to it, if you are happy with your carrier and they are doing a good job you should consider staying with them. That is of course assuming "good job" encompasses things like fair renewals and efficient TLRs.

At the end of the day, if you take away the marketing dollars, the new business discounts, and the other fluff that clouds the way, two identical groups with identical claims but different carriers should see the exact same rates.

Friday, April 30, 2010

Group Insurance Quotes

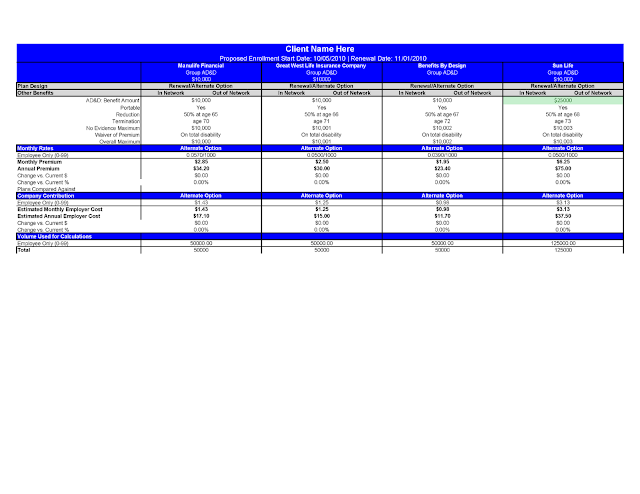

I've been busy running quotes for a few new group clients, as well as marketing a few existing groups to ensure prices are competitive. This hasn't left a lot of time for blogging. So I thought I would just post the stuff I have been working on. Below you will find a quote comparison for a group of mine, name removed for privacy. The group is currently with Benefits By Design, they are getting a 13% increase in their renewal rates, which I think is somewhat unjustified. So I have marketed the group to a number of carriers, I have included 5 in the comparison (Manulife, Equitable Life, Sun Life, Wawanesa and Great West Life). I have worked with all of these carriers and have confidence in the service and support they provide. As you can see the rates do vary from carrier to carrier, with Great West Life being the most expensive, though still providing a savings over BBD's original renewal. Manulife looks artificially cheap because they declined to quote on Long Term Disability for this group, we would need to add about $600 or so, to their premium, involve another carrier, possibly double up on some Life Insurance etc. so they have been eliminated from the running.

Sun Life is next in line, they are actually providing a savings of $278 per month over what the group is currently paying. This concerns me slightly as I think this is too cheap, I believe there is some heavy discounting going on here and that at next renewal there will be a corresponding increase. If the client is ok with the fact that next renewal will be high, than I have no problem taking the discount, but the client has to be aware of what they are getting into.

Equitable Life looks pretty good, both rates and efficiency wise. You will notice under health and dental the Target Loss Ratio (TLR) field. These number show how much of the premium is directed to claims and how much goes to admin. Ideally you want higher TLR's as this provide more money to pay claims, and less to overhead. Equitable is running 77.8% for health and 78.8% for Dental, this is far better than the current 73.4% and 75% BBD is providing. Wawanesa is the most efficient at 79.7% for both Health and Dental.

A Good example for looking at TLR efficiency is to compare the Health Care rates of Wawanesa with Manulife. Manulife has the less expensive premium of $2069 for health care, but also a lower TLR of 76%. Wawanesa looks more expensive at $2344 but has a higher TLR of 79.7%. When you compare dollars to dollars,

So while Manulife "looks" cheaper on the surface, Wawanesa will pay more claims, and also charges a little less in admin. At the end of the day having more money funneled to claims means better renewals and more stable premiums.

Assuming the client is comfortable with a sizable renewal next year I would be recommending Sun Life for a combination of best premium, meeting the plan design requirements, as well as having good service and support. If the client isn't comfortable with the idea of a large renewal then my fallback position would be Equitable Life.

Sun Life is next in line, they are actually providing a savings of $278 per month over what the group is currently paying. This concerns me slightly as I think this is too cheap, I believe there is some heavy discounting going on here and that at next renewal there will be a corresponding increase. If the client is ok with the fact that next renewal will be high, than I have no problem taking the discount, but the client has to be aware of what they are getting into.

Equitable Life looks pretty good, both rates and efficiency wise. You will notice under health and dental the Target Loss Ratio (TLR) field. These number show how much of the premium is directed to claims and how much goes to admin. Ideally you want higher TLR's as this provide more money to pay claims, and less to overhead. Equitable is running 77.8% for health and 78.8% for Dental, this is far better than the current 73.4% and 75% BBD is providing. Wawanesa is the most efficient at 79.7% for both Health and Dental.

A Good example for looking at TLR efficiency is to compare the Health Care rates of Wawanesa with Manulife. Manulife has the less expensive premium of $2069 for health care, but also a lower TLR of 76%. Wawanesa looks more expensive at $2344 but has a higher TLR of 79.7%. When you compare dollars to dollars,

Manulife comes up with $1572 directed to claims and $497 in admin.

Meanwhile

Wawanesa comes up with $1868 directed to claims and $476 in admin.

So while Manulife "looks" cheaper on the surface, Wawanesa will pay more claims, and also charges a little less in admin. At the end of the day having more money funneled to claims means better renewals and more stable premiums.

Assuming the client is comfortable with a sizable renewal next year I would be recommending Sun Life for a combination of best premium, meeting the plan design requirements, as well as having good service and support. If the client isn't comfortable with the idea of a large renewal then my fallback position would be Equitable Life.

Wednesday, April 14, 2010

More news on HST

Message sent on behalf of Nick Pszeniczny, Executive Vice-President, Distribution, and Rick Rausch, Senior Vice-President, Individual Retirement Investment Services.

Copies have been sent to regional directors, operation managers, Investment Managers and Consultants, Investments Administrative Coordinators, field management and administration personnel and staff associated with Individual Retirement and Investment Services.

Important information regarding the Goods and Services Tax and Harmonized Sales Tax – Impact on mutual funds and segregated funds

Alberta, Manitoba, Prince Edward Island, Quebec, Saskatchewan, Territories 5% federal GST only

What’s taxable?

Copies have been sent to regional directors, operation managers, Investment Managers and Consultants, Investments Administrative Coordinators, field management and administration personnel and staff associated with Individual Retirement and Investment Services.

Important information regarding the Goods and Services Tax and Harmonized Sales Tax – Impact on mutual funds and segregated funds

Effective July 1, 2010, expenses charged to investment funds and all investment management and advisory fees will be subject to the Harmonized Sales Tax (HST) in Ontario, British Columbia, Nova Scotia, New Brunswick and Newfoundland and Labrador.

The HST, a federally-administered tax, combines the Goods and Services Tax (GST) and the provincial retail sales tax (PST) into a single sales tax. The HST is new in Ontario and B.C., while new rules now make the tax in the existing HST provinces applicable to all funds.

What are the tax rates?

Province(s)/Territories HST rate

British Columbia 12% (5% federal and 7% provincial component)

Ontario, New Brunswick, , Newfoundland and Labrador 13% (5% federal and 8% provincial component)

Nova Scotia

British Columbia 12% (5% federal and 7% provincial component)

Ontario, New Brunswick, , Newfoundland and Labrador 13% (5% federal and 8% provincial component)

Nova Scotia

15% (5% federal and 10%

provincial component)

(as of July 1, 2010)

Alberta, Manitoba, Prince Edward Island, Quebec, Saskatchewan, Territories 5% federal GST only

What’s taxable?

The HST will apply to GST-taxable services that are charged to investment funds as well as to any investment management or advisory fees that are paid outside of the fund. These services are currently subject to five per cent GST. The HST will also apply to other services already subject to GST, for example annual trustee fees for RRSPs, RRIFs and RESPs.

The HST will not apply to expenses or fees that currently are not subject to GST such as insurance premiums (including premiums paid for benefit riders on segregated fund policies).

You may have seen media coverage of a proposed change in the definition of a financial service for GST purposes that would have the effect of introducing GST on commissions related to the sale and service of investment funds. Industry associations have opposed the nature and timing of this change in policy.

Federal Finance Minister Jim Flaherty has recently stated that no change in existing policy was intended, but rather just a clarification that all services previously taxed would continue to be taxed. This clarification was required following some 2009 court decisions against the Canada Revenue Agency (CRA) in this regard. We await confirmation from the CRA of the minister’s position.

What does this mean for investors?

The HST means a higher tax rate will apply to investment funds effective July 1, 2010. This will increase the costs incurred by the fund, where such costs are paid at the fund level, and for investors directly, where such costs are paid by the investor. Only half of the increase will be felt in 2010 due to the timing of the change.

The HST means a higher tax rate will apply to investment funds effective July 1, 2010. This will increase the costs incurred by the fund, where such costs are paid at the fund level, and for investors directly, where such costs are paid by the investor. Only half of the increase will be felt in 2010 due to the timing of the change.

How will the tax apply?

The specifics of how the HST will apply are not yet fully known. New rules defining what rates apply have been released for some sectors and discussed with industry representatives for others. We have been working with the federal, Ontario and B.C. governments for many months to try to address the challenges of applying various tax rates to a pooled product like investment funds. Industry associations continue to express concerns regarding the effects of this tax on Canadians’ ability to save and invest for retirement and other purposes.

The specifics of how the HST will apply are not yet fully known. New rules defining what rates apply have been released for some sectors and discussed with industry representatives for others. We have been working with the federal, Ontario and B.C. governments for many months to try to address the challenges of applying various tax rates to a pooled product like investment funds. Industry associations continue to express concerns regarding the effects of this tax on Canadians’ ability to save and invest for retirement and other purposes.

We will provide further detail once the government publishes the final regulations.

Labels:

HST,

mutual funds,

Seg fund,

Segregated Funds,

taxes

Tuesday, April 13, 2010

Ontario Drug Reform

The Ontario government is bringing in some interesting new changes in connection with their pharmacy laws. Manulife has a good little writeup on what is happening. In a nutshell to get pharmacies to stock generic drugs over brand name drugs, the generic drug companies are paying kickbacks to the pharmacies. These kickbacks increase the cost of the generic drugs. The government is putting a stop to these kickbacks and as a result dropping the cost of generic drugs. I think this is a great move by Ontario, and I would expect similar legislation to come to other parts of Canada in the near future if the plan succeeds.

On Wednesday, April 7 the Ontario government announced plans to reduce the price of generic drugs*.

If the new rules are approved, the price the pharmacy will be allowed to charge for a generic drug will be reduced to 25 per cent of the cost of the brand name drug. Currently, generic drugs cost group benefits plan members (and cash paying customers) between 60 and 70 per cent of the brand name price.

The change will affect the generic drug prices paid by

- the provincial drug plan,

- employer-sponsored group benefits plans, and

- individuals who pay for their medications out of their own pockets.

For employer-sponsored group benefits plans and individuals without a drug plan, the price reduction will be phased-in as follows**:

For the public plan, regulations will be posted for 30 days at which point it is expected that the prices will be reduced to 25 per cent. Further clarification is required to determine if there will be a period for pharmacies to dispense existing stock at the old price.

At the same time, the government announced the following:

- If approved, legislation will phase-out the professional allowances that are paid to pharmacists by generic drug companies. The government said these allowances have kept the price of generic drugs higher. Professional allowances will be eliminated on the public plan once legislation takes effect.

- Dispensing fees paid to pharmacists by the provincial drug plan (Ontario Drug Benefit Program) will increase by $1 to $8. In rural areas, the dispensing fee increase will be up to $4. The additional money for rural pharmacists is intended to help maintain easy access to medicine by residents in isolated areas.

- Dispensing fees paid by the provincial drug plan will then increase by 2.5 per cent annually over the next five years.

- A $100 million fund will be created to compensate pharmacists for new professional services that they will be allowed to deliver to patients. This is in addition to the MedsCheck program that already exists.

At this time, Manulife Financial is reviewing the implications the changes might have on plan designs. Manulife Group Benefits commends the province of Ontario for taking these actions to help

- control drug prices and give the people of Ontario access to affordable medicines,

- deliver better value for tax-payers, and

- protect employer-sponsored drug plans and the coverage they provide to millions of Ontario residents.

For more information visit the Ontario government website

Ontario.ca/drugreforms

*Generic is the term used to describe a drug product that has the same active ingredients as a ‘name brand’ drug but which is sold at a lower price. Laws prevent generic drugs from being manufactured until a name brand drug’s patent protection has expired.

** Based on information made available to the Canadian Life and Health Insurance Association at the time of publication.

© 2010 The Manufacturers Life Insurance Company. All rights reserved.

Manulife Financial and the block design are registered service marks and trademarks of The Manufacturers Life Insurance Company and are used by it and its affiliates including Manulife Financial Corporation.

Wednesday, April 7, 2010

Target Loss Ratio?

In a nutshell a TLR is the ratio of administrative expenses to claims payments. Every plan has expenses, paying claims, paying commissions, printing booklets, etc. These expenses are part of the overall premium you pay. At renewal time the insurance company seperates these expenses from your claims to determine your new premiums. Aside from plan design changes, the biggest impact you can have on premiums is reducing your administrative expenses, this translates into a better or higher TLR.

As a group grows they start to benefit from economies of scale and the TLR improves. A group of 10 members might have a TLR of 70%, which when flipped around means that expenses were 30% of premiums paid. A larger group of 100 might have a TLR of 85%, so expenses were only 15% of premiums. The higher the TLR the better.

Each insurance company has a differnt level of expenses, some of the more "value added" carriers like Great West Life, and Manulife tend to have a lower TLR becuase they provide more services and benefits all of which cost money. Some of the more basic providers such as Wawanesa, who dont have as many bells and whistles, can do things for less and have a better TLR.

For example I often find the big 3 (GWL, Sun, Manulife) will have the same TLR for health care and dental care.But if you actually look at claims settling expense dental care is FAR cheaper to administrate than health care. Furthermore, dental care doesnt require a stop loss charge in the event of a catastrophic claim.

One thing I really like about Wawanesa is they are one of the only carriers I am aware of, that charges a different TLR for Health Care vs. Dental Care. The Target Loss Ratio for Health might be 80%, while the Dental Care TLR is 85%. Most carriers would charge 80% for both, and pocket the difference.

So aside from the cost of expenses, what does a Target Loss Ratio mean to you the client? It can mean lower premiums.

Lets assume that we had a group with $50,000 of health care claims. Their current carrier has a Target Loss Ratio of 75%, in other words they require 25% to administrate the plan.

We can work backwards from the claims, and the Target Loss Ratio to find the premium the group would pay. The Total Premium for the group would actually be (50,000 / 0.75) = $66,666

75% of the premium is $50,000 in claims, and 25% of the premium is $16,666 in admin.

Given the same claims of $50,000 how much could the client save if they had a better TLR of 82%?

($50,000 / 0.82) = $60,975.60

By switching to a carrier with a better Target Loss Ratio the client would save $5,691

A trick I sometimes see inolves this same princple but working backwards. I will get a quote from a competing insurance company, which is cheaper than the existing coverage, however, the TLR is far poorer than the current carrier. Even though the premium looks cheaper, there are be fewer dollars directed to paying claims. This often results in a higher renewal next year.

Example:

Current premium $10,000

Current TLR = 72%

Dollars directed to claims = $7,200

Competing premium $9,500

Competing TLR = 65%

Dollars directed to claims = $6,175

So while the competing quote looks to save 5% over the current plan, the drop in TLR actually results in fewer dollars being used to pay claims, assuming the claims were actually the $7,200 budgeted in the current plan, the competing plan would need to raise rates by $1025 (ignoring trend etc) which makes the new carrier actually MORE EXPENSIVE than the current plan.

Take a look at your Target Loss Ratio and what you are getting for your premium dollars. If you don't need all the bells and whistles you might want to look into a more budget carrier who charges less.

Tuesday, March 30, 2010

Renewal Reports

I think I have some of the best Renewal Reports around. I have never once run into a more detailed renewal report from another adivisor. I produce a 21 page reviwing past claims, future trends, and specifics of each group. This is all above and beyond the base report that the insurance companies always produce. I include industry news, health care surveys, taxation worksheets, important reminders and a wealth of other information.

Sample Renewal (PDF)

This is an actual renewal from this month, I have redacted the name of the client for obvious reasons.

Examples of inserts

Cost Saving Plan Design Tips

Health Care Trend Survey 2009

Benefits Plan Taxation

If you want MORE information in your renewal, so you can make better decisions regarding plan design, carrier, usage etc.; Give me a call

/sales pitch

Monday, March 29, 2010

I'm having a good day today

I just got a negotated renewal back from an insurance company (Sun Life) for one of my larger clients.

Current Premium $17,290.14 per month

Original Renewal $18,704.62 per month (8.2% increase)

Negotiated Premium $17,385.05 (0.5% increase)

Negotiated Savings $15,834.60 over the next year.

I love it when i can save my clients nearly SIXTEEN THOUSAND DOLLARS, it makes me feel all warm and fuzzy inside.

Current Premium $17,290.14 per month

Original Renewal $18,704.62 per month (8.2% increase)

Negotiated Premium $17,385.05 (0.5% increase)

Negotiated Savings $15,834.60 over the next year.

I love it when i can save my clients nearly SIXTEEN THOUSAND DOLLARS, it makes me feel all warm and fuzzy inside.

Wednesday, March 24, 2010

HST on Insurance and Investments

I just received an email from Advocis, the insurance and financial services association I'm a member of. The topic was on GST/HST Notice No. 250

Furthermore, CRA is proposing that these changes be effective Dec 14, 2009. a full three and a half months in the past!

This means every advisor or insurance company has to go back into their records, and somehow collect GST on past sales? lunacy!

More as this unfolds.

CRA has indicated that trailer commissions, front-end

load commissions, deferred sales charges, commissions on various

insurance products and redemption fees paid by investors do not constitute a

supply of a financial service and will be subject to GST. It is not clear at this

point in time whether financial advisors will be required to register for GST

purposes and remit GST.

Currently the insurance and investment products are exempt from PST/GST/HST. Its been this way for years. In this latest notice CRA has indicated that they have decided to remove this exemption from certain policies. That means any new insurance or investment policies will now be GST-able or in BC HST-able. That means we have gone from no sales tax to 12% overnight. There is nothing in the notice which indicates who gets to deal with this change. Do the insurance companies take over the administration of remitting the tax? Does every advisor now need to register for GST/PST/HST? Unlike some products where the CRA says HST will actually lower prices because there will be a "flow-through" of PST that will not be the case with this change. There has never been GST or PST anywhere in the supply chain so we cannot pass along any savings. Furthermore, as well as the tax, there is going to be added cost in administration of these policies so base costs will be going up as well.

I think this is a terrible idea, why would the CRA want to discourage people from investing and purchasing insurance? Last time I checked CRA makes buckets off taxes on investments.

CRA has provided some handy dandy examples of when the service would be deemed non-exempt. according to the example below. CRA doesn't clarify exactly how this will apply to real world commissions, does it impact the commissions paid to the MGA? what about overrides or bonuses?

Example 2

In the course of providing services to investors, an investment dealer arranges to purchase units of a mutual fund for an investor. A commission is paid to the investment dealer at the time the units are purchased. In addition, the investment dealer will receive a fee referred to as a "trailer commission or fee" from the fund manager. The prospectus describes these fees as being paid in recognition of the investment advice and ongoing administrative services rendered by the investment dealer to the investors. The “trailer commission or fee” is paid annually subsequent to the arrangement for the purchase of the units. The services provided by the investment dealer, including advice, arranging for the purchase of the units and on-going administrative services for which the investment dealer is paid the commission and subsequent fees would not be a supply of a financial service.

For example, If I were to invest $100,000 of your money in an RRSP, I would be paid a commission of approximately 3% or $3000 (for a back end load policy), however, the MGA I placed the business through would also get paid 2%, for a total of 5%. Now is the 3% taxable or the 5%? We are talking CRA here, so lets assume they are going to be greedy and they tax the 5% commission paid to the MGA and the advisor. In BC the HST will be 12% so we are looking at 12% HST on $5000 of total commission. That is $600 in new taxes you will have to pay. This new tax just cost you 60 base points of return.

Coming into force

These proposed amendments would apply to investment management services rendered under an agreement for a supply if any consideration for the supply becomes due or is paid without becoming due after December 14, 2009. They would also apply to an investment management service rendered under an agreement for a supply if all the consideration for the supply became due or was paid on or before December 14, 2009, unless the supplier did not, on or before that day, charge, collect or remit any amount as or on account of tax in respect of the supply or in respect of any other supply that includes an investment management service and that is made under the agreement.

This means every advisor or insurance company has to go back into their records, and somehow collect GST on past sales? lunacy!

More as this unfolds.

Labels:

HST,

investments,

Life Insurance,

taxes

Friday, March 19, 2010

Please allow 6-8 weeks for delivery

I recently read somewhere (an now I have forgotten where, DOH) that it takes an average of 39 days to issue a life insurance policy from start to finish. That's a long time, and sadly I would say it is probably accurate, if a little on the optimistic side. I personally have two policies I have been working on for well over 6 months. One of which dates back to August 2009. In the good old days, or so I am told, it used to take a work week to get a policy issued.

Day 1: The advisor meets with the client and writes up the application.

Day 2: The application goes in the mail to the insurance company.

Day 3: The underwriter reviews the application and decides to issue or decline the policy.

Day 4: The policy goes back in the mail to the advisor

Day 5: The policy arrives on the advisors desk for delivery to the client.

These days things aren't so simple or so speedy. We have all sorts of things which add time, complexity and frustration to the process. The modern day time line looks something like this:

Day 1: The advisor meets with the client and writes up the application. The client forgot their cheque book, and since insurance companies no longer accept credit cards as payment no temporary insurance policy can be issued. The client really wants the temporary insurance so will get the advisor a cheque in the near future.

Day 6: The clients cheque arrives so the temporary insurance can be issued. The application is mailed to the Managing General Agency (MGA). The MGA acts as a middle man coordinating, problem solving and expediting between the advisors on the ground and the insurance company head office.

Day7: In the mail

Day 8: The application is received by the MGA, copied, sent to the insurance company

Day 9: In the mail

Day 8: The client completes the mandatory medical examination.

Day 14: The underwriter receives the application and the medical results. There is something missing, or a question, from the medical exam. An Attending Physicians Statement (APS) is ordered.

Day 16: The doctors office receives the information request and promptly ignores it for two weeks.

Day 30: The doctor finally completes the APS

Day 32: The Insurance Company receives the APS report from the doctor. In the meantime, the clients drivers license has expired and proof of the renewal needs to be provided.

Day 35: The advisor receives the new expiry date on the clients drivers license and sends it to the MGA.

Day 36: The MGA forwards the drivers license to the insurance company.

Day 38: The motor vehicle record search with the new drivers license shows a speeding ticket within the last 3 years, a motor vehicle questionnaire needs to be completed by the client. the Insurance company sends the request to the MGA.

Day 39: The MGA forwards the information to the advisor.

Day 40: The Advisor informs the client that a driving questionnaire needs to be completed. The client is on holidays for the next week, an appointment is scheduled for 9 days from today.

Day 49: The motor vehicle questionnaire is completed and forwarded to the MGA

Day 50: The MGA receives the questionnaire and forwards it to the insurance company.

Day 56: All the outstanding items are accounted for. The policy is approved and issued.

Day 58: The policy is printed in eastern Canada, it is mailed to the MGA.

Day 61: The policy is received by the MGA, they make a copy, add a pretty cover and forward it to the advisor.

Day 62: The policy arrives in the advisors office, the date of birth is incorrect. The policy is returned to the insurance company to be corrected.

Day 70: The correct policy is received by the advisor for delivery.

Day 72: The policy is delivered to the client.

I have had each and every one of the problems listed above happen, though not usually all on the same policy. The example above is exaggerated for comedic effect, but not by much. The system in place is so slow, chaotic and error prone it makes my head hurt at times. With MGAs, AGAs, different insurance offices and the like; the time it can take to get a policy issued can seem like eons. I know why they got rid of 5 year term, by the time the policies were issued, they had already expired. I harp on MGAs sometimes, but they do keep me on track and up to date on the progress of my clients applications. The insurance companies and MGAs aren't all to blame, I screw up sometimes too. My most recent disaster involved writing up an application with a client, only to find out that the paper form was out of date, and was invalid. a second appointment with the client had to be scheduled to go through the new app which I swear was exactly the same as the "old" one. How embarrassing.

So what can be done?

Every few year there seems to be a big push by one company or another to embrace electronic applications, but they always flop. Scanning and email are great for removing postal delays, but electronic signatures are still not accepted. The incredibly low rates for insurance we enjoy these days are due in part to extra diligence of the insurance companies. This extra diligence takes extra time, be it medical records or additional questionnaires. I have started the habit of sending two copies of everything, originals to the insurance company and a copy to the MGA. This adds time and effort on my end but has thus far improved my turnaround time slightly.

I honestly don't have an answer, problems occur all throughout the chain

- Advisor

- Client

- Courier

- MGA

- Doctors

- Insurance company

- Paramedical company

- Reinsurance companies

If there is anyone working in logistics at UPS or FedEX and you want to earn a bundle in consulting fees please help us fix our system, it's broken.

Subscribe to:

Posts (Atom)

_Page_13.png)